Mexico’s Manufacturing Boom

What Global Buyers Need to Know

Manufacturing in Mexico is gaining momentum with tax incentives, new investments, and infrastructure enhancements. 2025 is posied to be a pivotal year for the manufacturing companies seeking to expand, leverage nearhoring production, and reduce operational costs. As businesses continue to assess strategic locations and cost efficiencies, Mexico has drawn the interest of major players across the electronics, aerospace, and automotive industries. While the future looks promising for Mexico’s manufacturing sector, challenges persist. Regulatory uncertainty, change in global economic policies, and competition from low-cost countries can impact Mexico’s economy. Also, the industry faces rising wage pressures as demand for labor intensifies, affecting cost benefits in the long haul.

This blog examines the overview of Mexico’s manufacturing growth and challenges spanning across diverse industries like automotive, luxury goods, and electronics. Also, how Quloi’s centralized platform for documentation and data exchange helps streamline supply chain and logistics.

Automotive Manufacturing: A Global Powerhouse

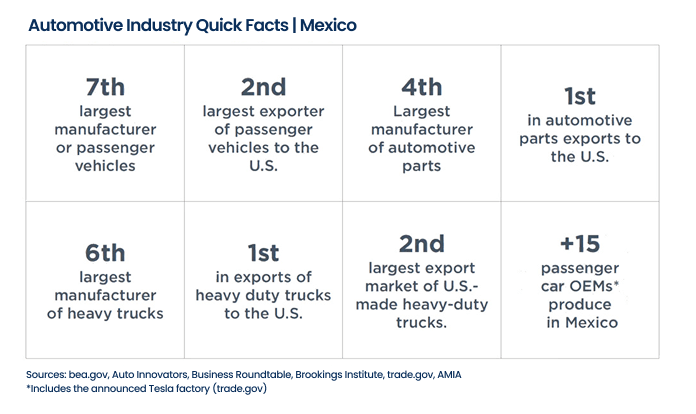

Mexico’s automotive sector has numerous manufacturing plants, setting new benchmarks in recent years. The thriving Mexican manufacturing hub, teeming with global players such as BMW, Audi, Kia, and Tesla, positions the country as a key player in the global automotive supply chain. With its robust network of suppliers and ancillary businesses, Mexico is the seventh-largest passenger auto manufacturing hub. In 2024, Mexico manufactured 3,989,403 light vehicles, representing a 5.56% increase over 2023 and surpassing the previous record set in 2017. This growth will likely continue with a projected 2.7% increase in 2025.

The automotive industry’s expansion is not limited to the production of traditional internal combustion vehicles. Mexico is leading the charge in electric vehicle (EV) production and the manufacturing of electromobility components. Major automakers, including Toyota, General Motors, and Stellantis, have ramped production of high-performance electric and hybrid vehicles in Mexico. Notably, General Motors maintained its position by increasing its output by 23% in 2024, encompassing EV vehicles. This shift underscores Mexico’s strategic role in the global transition to innovative manufacturing solutions, which is poised to gain further strength.

Electronics Industry: Rapid Expansion and Investment

Mexico has solidified its position as one of the world’s leading hubs for electronics manufacturing. The country’s electronics sector is a critical pillar of economic growth, attracting over $7.8 billion in foreign direct investment (FDI) over the past two decades. Key investment hubs include Baja California, Jalisco, and Tamaulipas, with emerging centers in Mexico City, San Luis Potosi, and Chihuahua. Cities like Monterrey and Tijuana have become hotspots for advanced electronics manufacturing, hosting prominent players like Samsung and Flex.

The sector is rapidly expanding, with Baja California projected to experience a 35% increase and Monterrey a 30% increase in electronics manufacturing output over the next two years. The rising global demand for electronic components, particularly those integrated into consumer electronics and the automotive sector, has positioned Mexico as a strategic player in the electronics landscape.

Luxury Materials and Footwear: Emerging Market with Growth Prospects

The rise of the luxury market, particularly luxury footwear, is gaining traction in Mexico, with a clear preference for brands that emanate brand recognition. The luxury footwear segment is expected to grow at a compound annual growth rate (CAGR) of over 5% from 2024 to 2029. This growth is supported by Mexico’s flourishing tourism economy and its rich tradition of craftsmanship. Additionally, Mexico remains North America’s top destination for luxury travel, differentiating itself from other countries in selling luxury products.

Despite Mexico’s consistent growth trajectory, the luxury market faces challenges such as regulatory complexities, import fees, and an underdeveloped local luxury manufacturing infrastructure that relies heavily on imports, thereby increasing costs. Understanding such factors is vital for global buyers aiming to source Mexican luxury goods.

Challenges in Mexico’s Manufacturing Landscape

Fragmented Supplier Networks: As global supply chains diversify and companies nearshore operations to Mexico, managing a mix of local, international, and newly established suppliers becomes difficult. This fragmented supplier network leads to reduced visibility, operational inefficiencies, and increased risk. After opening two factories in Mexico and Juarez Toy-maker MGA Entertainment continued to maintain its US factory and its relationship with Chinese suppliers. While being resilient, this multi-sourced approach creates a highly fragmented supplier network.

Tariff Uncertainty and Trade Policy Shifts: The specter of new tariffs imposed by Trump on Mexican exports looms large over the manufacturing sector. The lack of clarity and possibility of future executive action on tariff policies create a climate of uncertainity. Economists claim that tariffs, while generating short-term revenue, can reduce demand for Mexican goods. This makes manufacturing more expensive and less competitive. This uncertainty complicates long-term production planning. Manufacturers face a stark choice in investing in Mexico against other low-cost production hubs.

The Shifting Dynamic of Nearshoring: Mexico has emerged as a hubspot for nearshoring, relocation production closer to North American markets to address supply chain risks. Cost efficiency, proximity, and same-day delivery options are the key drivers. Mexico registered a record of $31 billion in FDI in 2024. This growth trend is expected to continue, estimating nearshoring to add 3% to Mexico’s GDP over the next five years. However, with rapid growth comes challenges. Industrial real estate is in high demand, leading to increased costs in Juarez, Monterrey, Tijuana, and Ciudad.

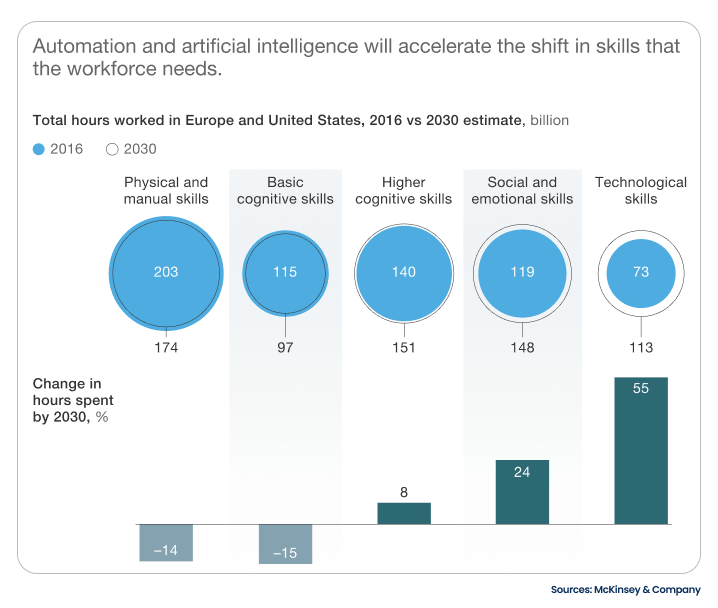

Workforce Development and the Skills Gap: Mexico’s manufacturing sector directly employs about 3 million people, with millions more dependent on the industry. As automation, robotics, and advanced technology creates a dominating effect, the need for skilled labor is intensifying. Industries like electronics and aerospace face acute skills shortages, encouraging collaborations between industry stakeholders and educational institutions. A McKinsey report predicts that soft skills such as communication, adaptability, and emotional intelligence will be twice as important as technical skill for most jobs by 2030. Mexican manufacturers increasingly recognize that technical know-how alone is insufficient; workers must master teamwork and digital literacy.

Customs and Border Bottlenecks: Customs processes in Mexico present significant bottlenecks that can disrupt supply chains. Common pitfalls include inconsistent paperwork, licensing restrictions, inaccurate paperwork, manual processes, reconciliation inaccuracies. These challenges often result in shipment delays, escalating costs, audits, penalties, and impact delivery schedules. Border inspections and increased freight costs have complicated logistics, negatively impacting OTIF performance and overall efficiency.

How does Quloi Help?

Quloi offers a comprehensive platform built to centralize supplier communication and streamline customs clearance. By integrating supplier data, communication channels, documentation into a single interface, Quloi enhances coordination and transparency across the supply chain.

Quloi’s robust solution facilitates seamless data exchange and encourages smooth collaboration among customs brokers, forwarders, and shippers. This ensures easy accessibility of shipment details and customs documentation in multiple languages for cross-border trade. Quloi ensures stakeholders proactively track shipments through real-time logistics visibility and address potential issues to reduce D&D charges. This approach enables manufacturers and global buyers to navigate Mexico’s regulatory landscape efficiently.

Book a free DEMO today to harness full potential of Quloi’s supply chain and logistics platform and secure its competitive advantages in interconnected world economy.