Supply Chain Challenges in the Textile Industry

The textile industry is a cornerstone of global commerce, weaving fashion, functionality, and technological innovation. However, the industry has also felt the quagmire of the global economic slowdown, inflation, and escalating armed conflicts worldwide. After the economic slowdown, the industry is returning to the path of progress. Textile manufacturing is poised for growth, driven by increasing demand for online shopping. The online shopping trend allows textile manufacturers to expand their product reach to a broader audience, diversifying their customer base geographically and contributing to the overall growth of the textile manufacturing market. Notably, India, the world’s largest producer of textiles, has witnessed increased sales of traditional garments with the surge in e-commerce platforms.

Since the global textile industry has traditionally been product-focused, it faces headwinds due to the rapid pace of advancements and evolving consumer preferences. This blog will cover a global outlook of the textile industry and the critical supply chain challenges textile manufacturers face.

Common Challenges in the Textile Supply Chain

Raw Material Variability

The erratic availability and quality of raw materials like cotton, silk, glass fiber, polyester, and dyes have been a constant challenge for textile manufacturers. Variations in material quality due to pests, weather conditions, harvesting and processing methods, seasonal changes, grading standards, or geopolitical issues (like trade tariffs) can disrupt production schedules, affect product consistency, and squeeze profit margins. In a McKinsey survey, fashion executives cite geopolitics as their primary concern, followed closely by economic volatility. 62% of executives cite geopolitical instability as the foremost risk to growth, while 55% cite economic volatility.

Logistical Concerns

The textile industry relies heavily on global raw materials and finished goods trade. Inadequate port infrastructure and inefficient handling choke supply chains, shipping schedules, and the overall economy. According to the Bureau of Transportation Statistics, the transborder freight between the US and its North American neighbors, Canada and Mexico, experienced a 2% increase in May 2024 compared to May 2023. Conversely, Indian importers and exporters deal with cargo delays at Mundra Port, the nation’s primary containerized hub. Truckers are facing longer waiting times to access and transport containers due to their inability to obtain entry permits promptly. Such logistical issues become challenging for textile manufacturers in the case of time-sensitive goods such as seasonal fashion collections.

Demand Fluctuations

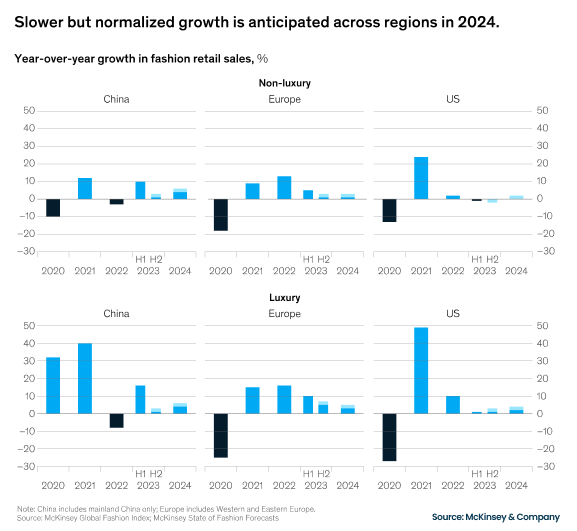

Textile products often experience fluctuating demand influenced by fashion cycles, seasonal trends, and regional preferences. For instance, demand for winter coats peaks in colder months, while lightweight fabrics and swimsuits see increased demand during summer. Due to seasonal demand fluctuations, forecasting and production planning become a challenge. Also, shifts in customer demand lead to a bullwhip effect in the supply chain. According to McKinsey’s study of fashion forecasts for 2024, the global industry is set to experience top-line growth of 2 to 4%, with noticeable regional and country-level variations. Once again, the luxury segment continues to generate economic profit. However, challenges caused by the tough economic environment weigh heavily on the fashion industry. Globally, the segment is projected to grow by 3 to 5%, a slight decrease from the 5 to 7% growth observed in 2023.

Fast Fashion

The changing dynamics of the fashion industry has reduced product lifecycles and increased demand for rapid production and delivery. Textile manufacturers face fierce competition to offer style-conscious consumers access to trendy, affordable items. About 25% of the youth in Turkey frequently renew their wardrobes, influenced by fast fashion outlets, contributing to harmful landfill waste and excessive C02 emissions.

With changing consumer demands, the inability to accurately forecast or predict future trends or failure to quickly produce fashion apparel can lead to longer lead times. This also increases pressure on suppliers to deliver vast quantities of desirable items quickly. Against this backdrop, the fashion industry is challenged by its contribution to increased waste and environmental impact. According to the UN Environment Programme (UNEP), the fashion industry is the second-biggest consumer of water and accounts for about 10% of global carbon emissions. This exceeds the combined emissions from all maritime shipping and international flights.

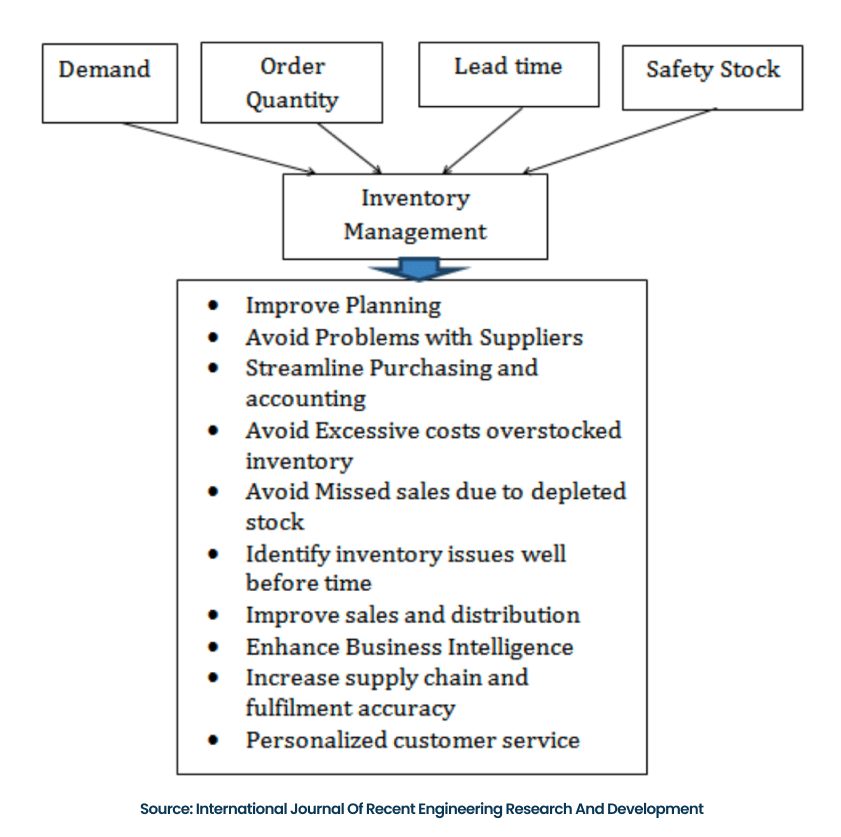

Poor Inventory Management

The changing dynamics of the fashion industry has reduced product lifecycles and increased demand for rapid production and delivery. Textile manufacturers face fierce competition to offer style-conscious consumers access to trendy, affordable items. About 25% of the youth in Turkey frequently renew their wardrobes, influenced by fast fashion outlets, contributing to harmful landfill waste and excessive C02 emissions.

With changing consumer demands, the inability to accurately forecast or predict future trends or failure to quickly produce fashion apparel can lead to longer lead times. This also increases pressure on suppliers to deliver vast quantities of desirable items quickly. Against this backdrop, the fashion industry is challenged by its contribution to increased waste and environmental impact. According to the UN Environment Programme (UNEP), the fashion industry is the second-biggest consumer of water and accounts for about 10% of global carbon emissions. This exceeds the combined emissions from all maritime shipping and international flights.

Technology Integration

Advanced manufacturing technologies such as 3D printing, bio-fabrication, and digital textile printing can increase design flexibility, customization, and precision. Nanotechnology, a breakthrough innovation, enables the creation of fabrics with enhanced properties such as water repellence, high tensile strength, and antimicrobial features. This innovation can enhance a fabric’s water-repellent properties by creating nano-whiskers that cause water to bead on the fabric’s surface. The global textile industry is undoubtedly a hotbed for technological innovations. However, integrating these technologies requires significant investment and expertise. Integration of these technologies in textile manufacturing is more than adopting new tools, it’s about reimagining the entire production process, and companies are afraid to take the lead.

Looking Ahead: Knitting the Future

The textile industry is dynamic, with diversified and functional products across all countries. Despite facing challenges, it has a promising future, provided that textile manufacturers invest in technology, adopt sustainable practices, and contribute to economic development. The intensifying competition in textile supply chains impels manufacturers to leverage cloud-based platforms that increase productivity, reduce lead times, and optimize logistics. The supply chain visibility and collaboration software, Quloi, helps you navigate the complexities of your textile supply chain effectively.

How?

- Monitor the status of textile orders in real time.

- Track shipments across road, air, and ocean routes.

- Strengthen collaboration with freight forwarders to optimize logistics.

- Integrate seamlessly with existing ERP systems to eliminate data entry errors.

- Utilize dedicated workspaces to enhance productivity and accountability among textile supply chain teams.

- Simplify logistics planning and minimize lead times for textile shipments.

- Integrate with Slack and Microsoft Teams for seamless communication and quick decision-making.

Maximize the potential of the textile supply chain with Quloi’s FREE One-on-One Expert Consultancy. Our experienced consultant can provide expert technical guidance for effective supply chain management in the textile industry.

Related Articles